Top 10 Brilliant Money-Saving Tips to Boost Your Finances

Learn these top 10 brilliant money-saving tips in this article to reach your financial goals without tears. Neglect them and stay beaten by financial struggles and problems.

With the uncertain global economy, saving becomes crucial for you. It helps you stay prepared and secure in the face of unexpected financial challenges.

Ready to discover these 10 ways to save money, no matter your income? Let’s jump in.

List of the Top 10 Brilliant Money-Saving Tips

- Create a Budget That Works

- Automate Your Savings

- Cutting Unnecessary Expenses

- Get the hang of meal planning

- Take Advantage of Shopping Deals (like Discounts, Coupons, and Cashback)

- Review and Negotiate Bills Regularly

- Invest in Energy Efficiency

- Create Alternative Sources of Income

- Build an Emergency Fun

- Invest time in DIY Financial Education

Top 10 Brilliant Money-Saving Tips Explained in Detail

Many people struggle financially because they’re unaware of the clever ways to save money, even on a tight budget. Below are ten realistic ways to save money each month:

1. Create a Budget That Works

Having a feasible budget is crucial for your financial success. Often, it starts with tracking your income and expenses and identifying areas to cut back. Doing this, of course, helps you allocate savings.

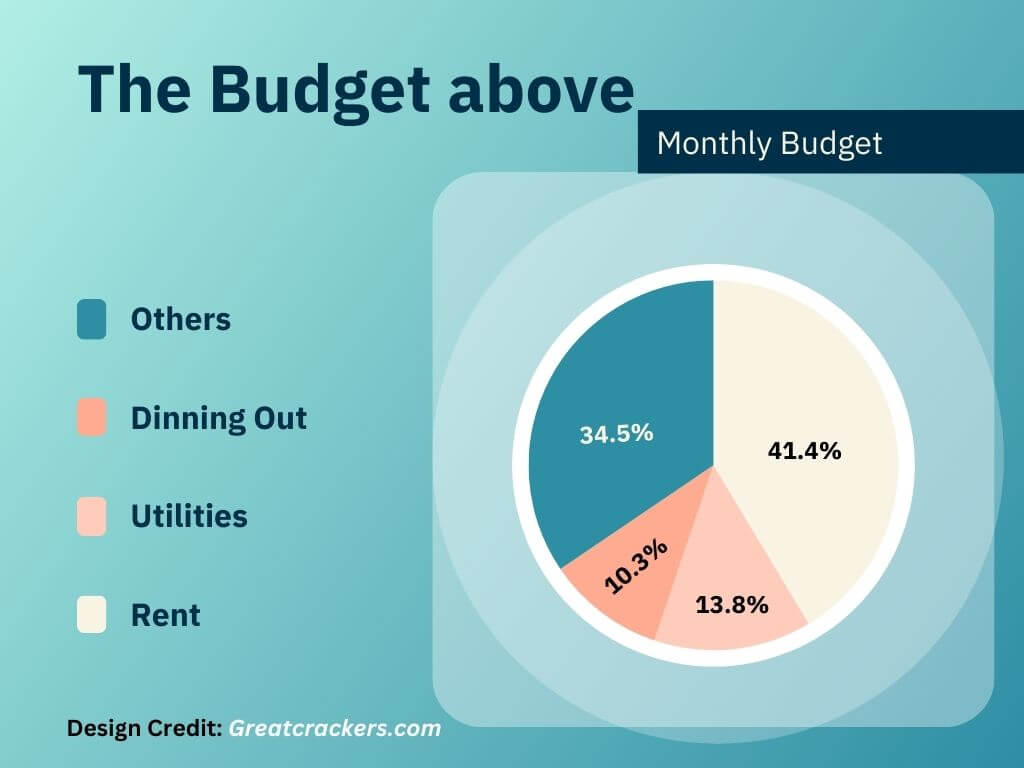

For example, if dining out is a regular and major expense, you can set a monthly restaurant budget. Let’s say your monthly income is $3,000. You can allocate $1,200 for rent and $400 for utilities while you set a $300 limit for dining out.

Such a disciplined approach allows you to meet your financial goals. And that, in turn, paves the way for your long-term stability and wealth accumulation. Thus, creating a budget tailored to your lifestyle is a brilliant money-saving strategy for a brighter financial future.

2. Automate Your Savings

We live in a world of automation, and that could apply to your savings. Not sure how automating your savings is one of the top 10 brilliant money-saving tips for you?

It involves setting up automatic transfers from your checking to your savings account at a specific time of each month. This way, you treat savings like a non-negotiable bill, allowing you to stay consistent.

For instance, you can schedule a transfer on your payday. This method helps you imbibe a saving habit, which allows your money to grow consistently.

Removing the manual effort helps you stick to your savings goals and build a financial safety net. Your money goes into savings without you having to think about it.

3. Cutting Unnecessary Expenses

Trimming unnecessary expenses is a practical tip to save money and achieve financial health. And it involves analyzing your spending and identifying non-essential costs.

For instance, brewing coffee at home instead of buying it every day can save over $1,000 annually. Though the daily expense might look small, it adds up in 12 months. The key is distinguishing between your wants and needs.

According to Think with Google, 1 in 3 holiday purchases is impulsive – in-store or online. But you can gain control over your finances and build a more secure financial future by curbing such indulgences. That’s because doing that allows you to redirect your funds to savings or debt reduction.

4. Get the hang of meal planning

Seeing this as one of the top 10 brilliant money-saving tips on this list may seem a mundane task. But in reality, the discipline to do that can help you boost your savings and finances.

When you strategically organize your grocery list, you reduce impulsive purchases. In addition, you trim expenses and foster healthier eating habits by preparing meals in advance.

Renowned financial advisor Suze Orman wisely said, ‘You can save a lot of money by cooking your own meals.’ You see why planning your weekly menus is crucial. It helps you minimize food waste and promote cost-effectiveness.

5. Take Advantage of Shopping Deals (like Discounts, Coupons, and Cashback)

As Warren Buffett wisely said, “Price is what you pay, value is what you get.” Before making purchases, you can explore available discounts and use coupons.

Of course, offerings like cashback on purchases are good ways to save money each month. For instance, leveraging cashback rewards on credit cards can result in significant returns.

That said, this strategic shopping helps you stretch your budget. Also, it transforms every purchase you make into a potential savings opportunity. And in the end, that bolsters your financial strength and stability.

6. Review and Negotiate Bills Regularly

This proactive approach allows you to free up funds for savings or debt reduction while long-term financial well-being. So, ensuring you’re not overpaying for essential services.

According to NerdWallet, you can often negotiate bills. Even if you can’t get a better deal, it’s worth trying. You have nothing to lose.

Hence, you should scrutinize services like cable, internet, and insurance for potential savings. For instance, renegotiating your cable package or shopping around for insurance quotes can yield substantial reductions.

Consider your monthly cable bill; a simple call to your provider could result in a discount of $20 per month. And if that’s the case, you can rack up a savings of $240 in one year.

7. Invest in Energy Efficiency

As one of the top 10 brilliant money-saving tips, investing in energy efficiency boosts your finances. Simple changes like upgrading to LED bulbs can help you cut utility bills.

For instance, replacing your incandescent bulbs with LEDs can save money at home for you per year. In other words, new, energy-saving appliances can save you hundreds of bucks each year. They’re clever ways to save money on a tight budget for you.

8. Create Alternative Sources of Income

You may have never considered creating alternative sources of income for yourself. But it’s a practical tip to help save more. That’s because you’ll save more money if you earn more.

As Warren Buffett wisely notes, “Never depend on a single income. Make investment to create a second source.”

So, considering taking up freelance work, a side business, or investment opportunities is crucial. For instance, dedicating a few hours weekly to freelance gigs can add $500 monthly or even more.

Of course, this diversified approach increases your income streams. Also, it provides a financial cushion for you, which eventually accelerates your journey toward financial freedom and stability.

9. Build an Emergency Fund

You can strengthen your finances by creating an emergency fund – one of the most realistic ways to save money. You can aim for three to six months’ worth of living expenses when buying an emergency fund.

A survey reveals that 40% of Americans can’t cover a $400 emergency expense. Setting aside, for example, $100 monthly quickly accumulates a $1,200 emergency fund in a year.

This proactive step shields you from unforeseen financial setbacks. Besides, it fosters a robust and secure financial future accompanied by peace of mind.

10. Invest time in DIY Financial Education

Did you know many people experience distress in their personal finances because of a lack of financial education? That’s why investing in financial literacy is part of the top 10 brilliant money-saving tips you should take seriously.

Of course, you can seize and utilize free online resources, books, and courses to achieve that. Warren Buffett advises, ‘The more you learn, the more you earn.’

Knowing the basics of investing can help you avoid unnecessary fees and make smarter investment decisions. As a result, you have money to save.

Taking control of your financial decisions promotes financial independence and gives you the knowledge to make informed choices. In the end, this enables you to enhance your financial well-being and contribute to long-term savings.

FAQ on tips on how to save money

How can I save money and be smart?

You can make smart spending choices by creating a budget, trimming unnecessary expenses, and prioritizing needs over wants. Also, establishing an emergency fund, investing for long-term goals, and educating yourself on personal finance are all vital.

What is a clever way to save money?

A clever way to save money would be setting up automatic transfers to a separate account monthly. That’s what you may call automating your savings, which allows a consistent approach without relying on willpower. Also, taking advantage of cashback rewards and discounts while shopping helps add up to your savings.

Final Thought

When you gradually adopt these money-saving strategies, you give yourself the opportunity to achieve enduring financial success. From budgeting to DIY financial education, each step contributes to a more secure future for you.

Consistent application of these brilliant tips for saving money optimizes your finances. On top of that, it fosters a robust financial foundation and a positive impact on your overall well-being.

Ready to start small, think long-term, and watch your financial resilience grow?

![Practical Ways to get rid of Lazy Workers at Workplace [Explained]](https://greatcrackers.com/wp-content/uploads/2022/03/dealing-with-lazy-workers.jpg)